Coffee Space

Coffee Space

I’ve been keeping an eye on the markets recently and decided to write a Python program to pull the data, so that I could do my own processing on stock data.

The idea here is to make some rough predictions and see how well they measured up with reality. If I can prove to myself that I have predictive capability, then it might be worth actually doing some investment. If not - then I need to keep learning.

Of course we cannot monitor everything, so I have chosen a few key markets with respect to the COVID situation, inflation and Russia-Ukraine invasion. I may choose to change these as I learn more or the situations around these markets change.

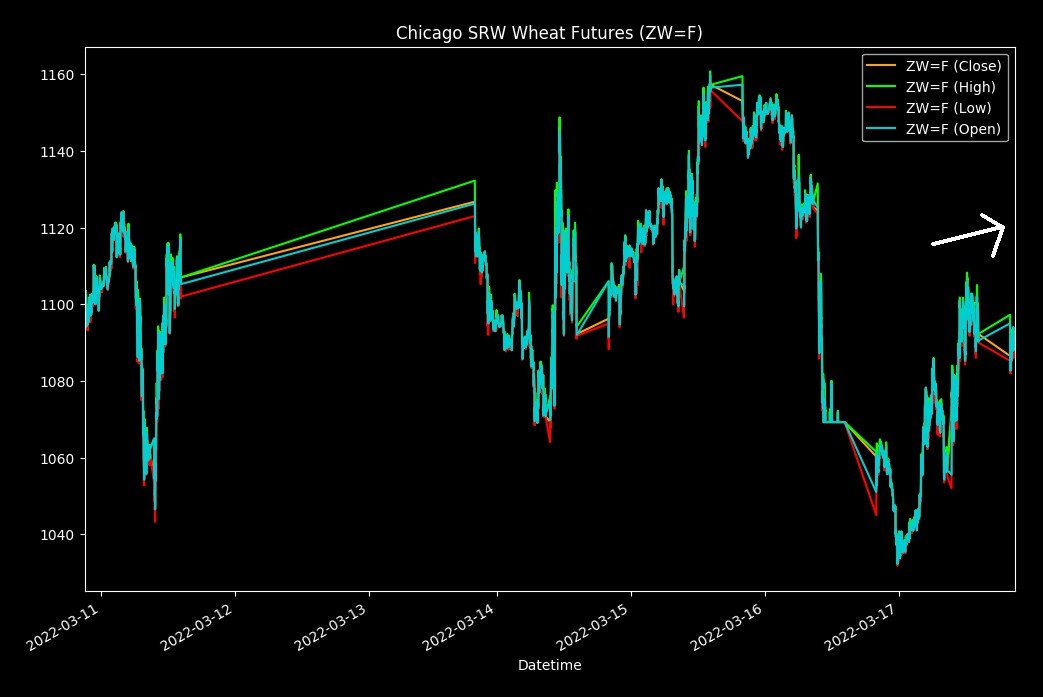

Why chosen: As I mentioned previously, increased wheat prices is extremely bad for everybody. At the minute I find this a highly interesting market to keep an eye on.

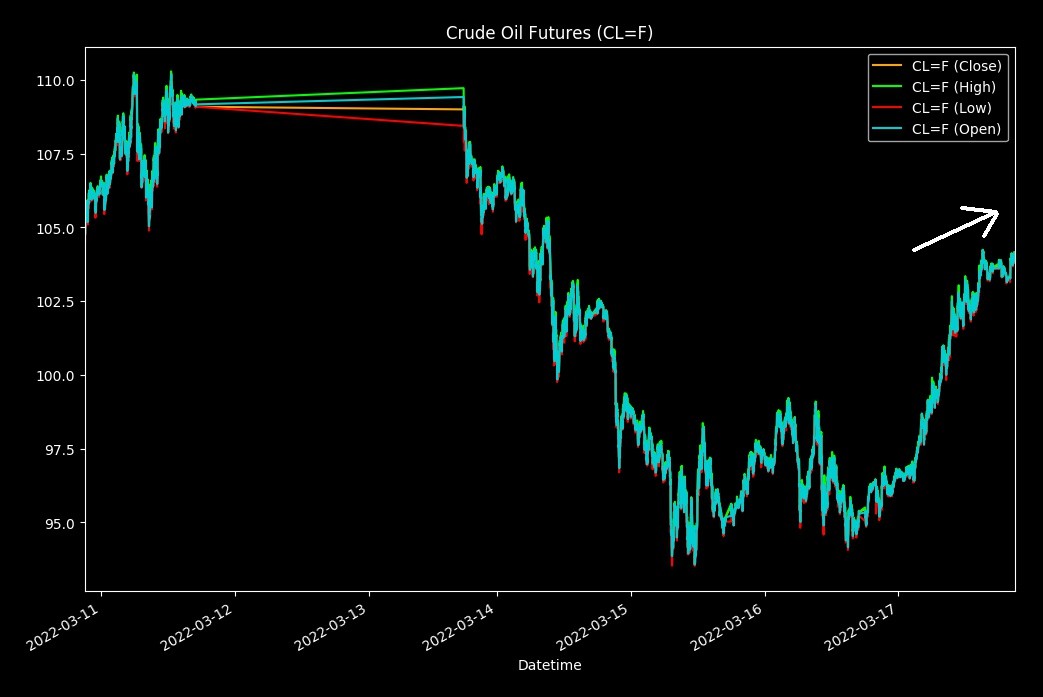

Why chosen: We had massive market volatility in crude oil in the last month, with oil prices driving a bunch of key policies.

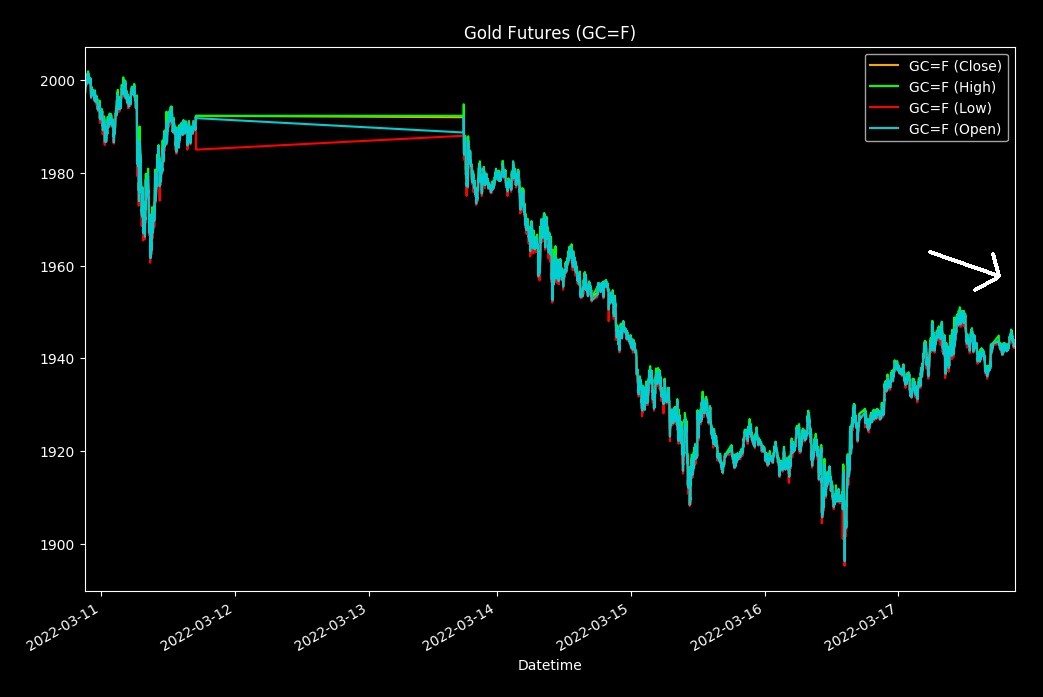

Why chosen: Whenever the average person on the streets think things are about to go badly, they always say something like “well, time to invest in gold then”. Obviously this is just buying high and selling low, but it should be a good market confidence indicator.

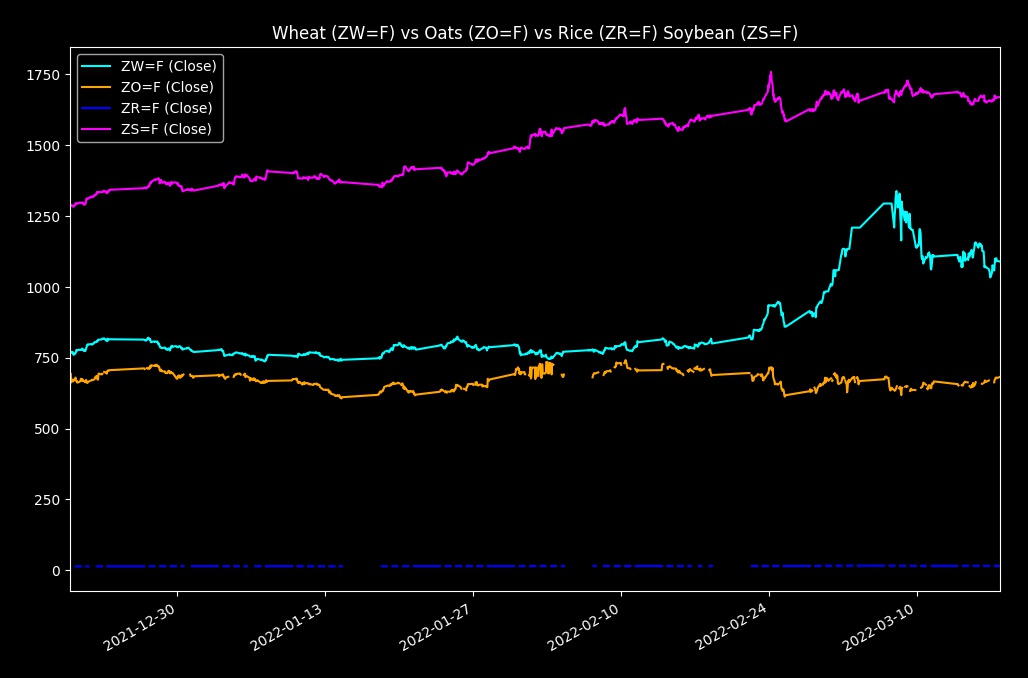

Why chosen: Grains are single handedly the most important thing a society can have - without them we essentially see a return to anarchy. With the current food insecurity issues we have seen with wheat, it seems prudent to keep an eye on other key food futures too.

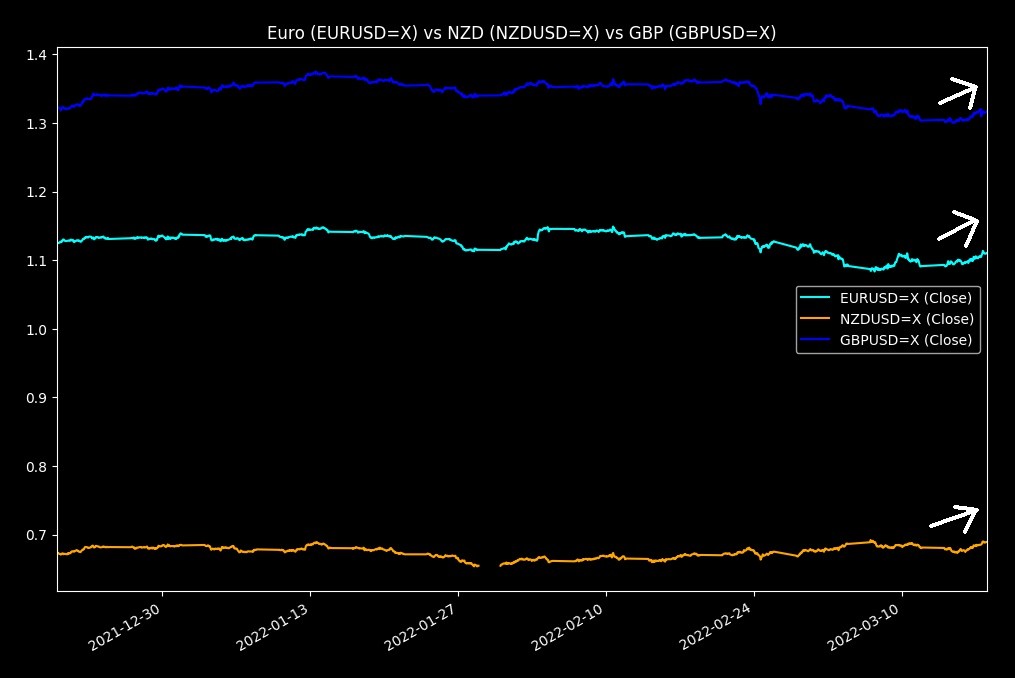

Why chosen: This is simply tracking some of the most important markets to me, which include USD, EUR, NZD and GBP. This gives us a rough idea of how the world economies are doing. This appears to be significant at a time when we see a lot of inflation.

These predictions are based on the current data (of course).

I expect wheat to somewhat rise over the next week, but nothing too strong. It will likely round over as I expect the market is now mostly out of the shock of the Russian invasion of Ukraine and it more accurately reflects the real situation.

Talks between Russian and Ukraine seem to be going well, and then don’t - despite actually quite good terms from the Russians. I expect that Ukraine are holding out for more favourable terms whilst they have the attention of the West.

If Ukraine and Russia are able to essentially find a peaceful solution in the next few days, losses of corn may be just one third. I have some doubt this will be the case.

Oil is quite likely to continue to increase. There are predictions for $200 oil before the end of the year, with the idea of a Petroyuan being floated around to replace the Petrodollar.

Gold is quite likely to slowly come back down as the initial panic of the Russia-Ukraine invasion settles. I would expect that if a deal is found, there may be a surplus of gold as Russia looks to dump theirs to generate some much needed cash.

I expect we see grains in general slowly creep up, specifically wheat and soybeans as Argentina export banned them for their own food security. If more Countries decide to start restricting the export of foods, all bets are off.

Lastly we see a small but noticeable increase of all the tracked currencies vs USD. It appears the common factor here is a weakening US dollar as Biden has turned the money printing machines back on again. Pelosi also seems to believe that printing more money reduces debt. You could argue that it does in a sense, by introducing a working-class tax and giving those funds to the people doing the printing (the US government).

The problem for them is, it both causes massive inflation and creates a really difficult time for the working class. For some, they literally cannot afford to put the fuel in their car to drive to work.

In the future, I may want to track the following things:

For future graphing, it would be good to plot:

Anyway, let’s see how it goes!