Coffee Space

Coffee Space

So previously I discussed the crypto crash, where we saw a drop from approximately 30k down to 20k. In this article we will discuss more concerning news for the crypto market.

Since the previous post, we have not yet seen another crash down from the 20k point - if anything BTC and the like have actually went up.

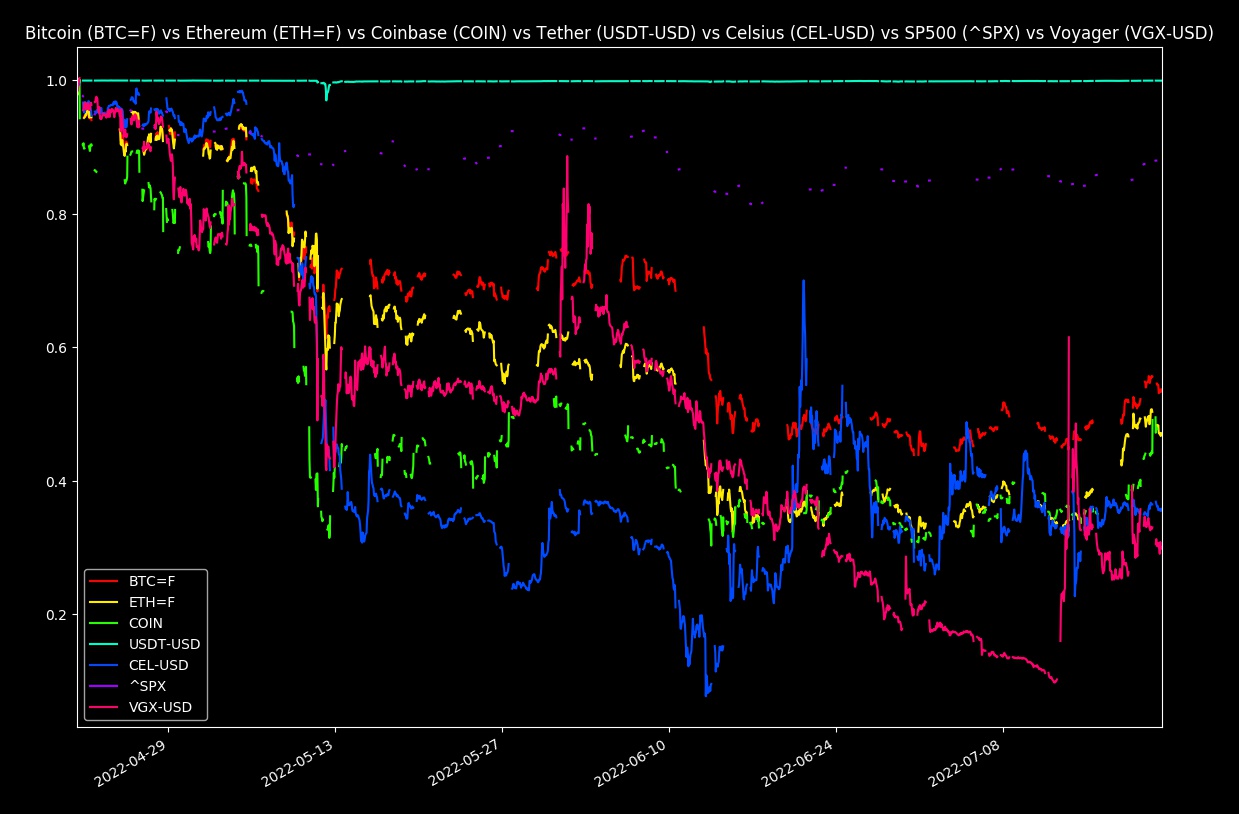

As you can see on the 3 month scale, we are yet to see any significant crash or raise of crypto. It appears to be holding steady at approximately 20k, with a small rise seen more recently.

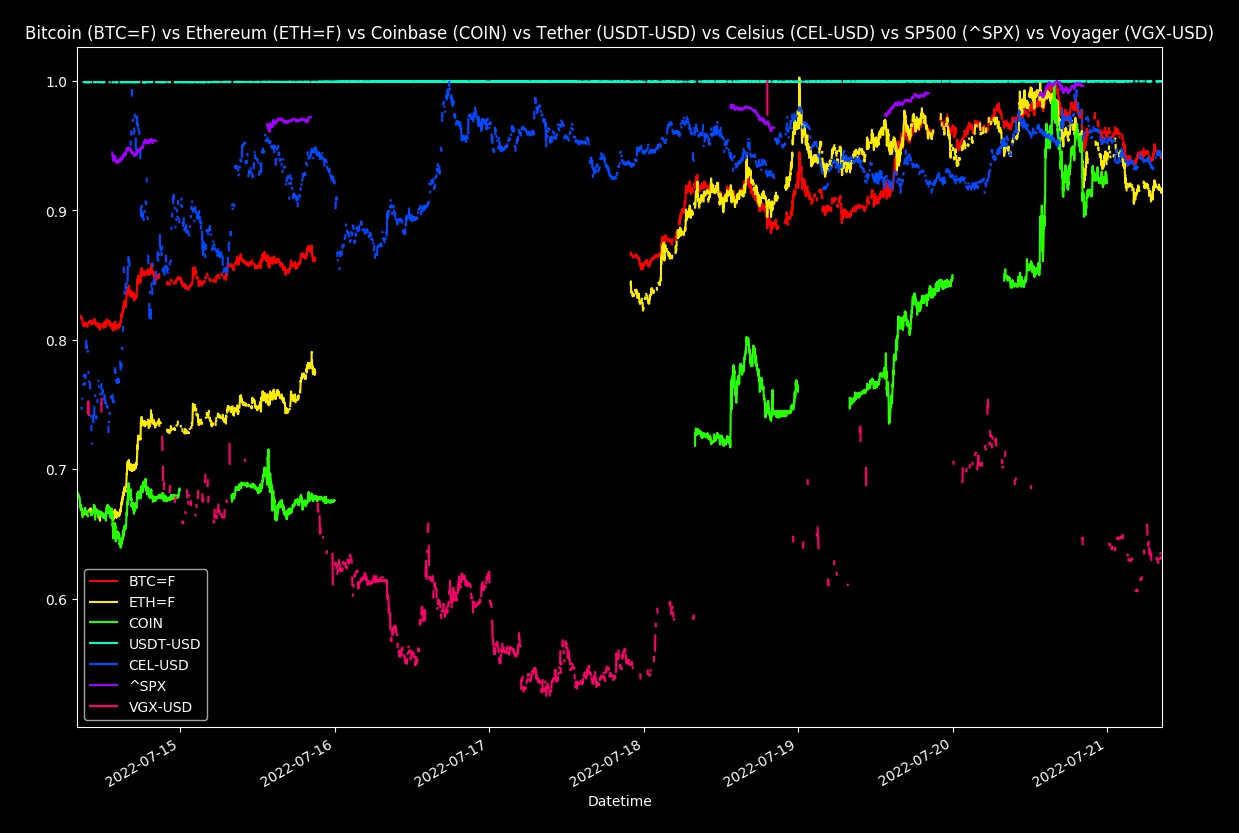

Here we have a 1 week view of the same crypto graphs. Here the recent rise is much more evident. Both graphs are normalised as the values in the graphs are significantly different.

Despite this seemingly positive market turn, we will now go on to discuss several factors that will likely drive the next crypto crash.

It has been known for a while now that both Voyager and Celsius are bankrupt. Both are trying to hold out as long as they can, but they are pretty much destined to fail unless the economy picks up ASAP.

If you check back again at the graphs, Celsius and Voyager are trading far too high. People have for whatever reason bought into the idea that these debt-ridden companies will somehow bounce back, despite filing for Chapter 11 bankruptcy. Insanity.

At a time where you need large whales to stay true, players such as Tesla are dumping their Bitcoin. The result has been a drop in Bitcoin’s value. The only reason that even know this is that Tesla have to declare what they are holding for the purposes of taxation. Imagine what is going on where we cannot see?

I highly suspect that the exit of large whale wallets is being ‘covered’ by smaller traders “buying the dip”. Once this FOMO (fear of missing out) runs out, what do we expect to happen? A lot of small players suddenly start losing a lot of money. Think it can’t happen? Just checkout the Gamestop saga.

Crypto, in it’s infinite wisdom, decided it needs to invest the US dollars it accrued into high-return, diverse assets. The strength of the crypto currency is ultimately the value of the assets they hold. This doesn’t sound too bad, except the high yield assets that many crypto currencies used was the Chinese housing market.

Things were already looking rocky, but China now has a homebuyer mortgage boycott. This means that stressed banks will have to be more careful about issuing mortgages for home buying, knowing that some people intend to join the protest in not paying it back. This will have the effect of slowing down the Chinese housing market 1.

The other issue with the high-return assets that crypto has invested in is that they are not easily liquidated. Tether for example has had to find billions of dollars in a single day, the act of mass selling itself causes the asset to become less valuable.

To prevent this, they likely get loans from large names (like Goldman Sachs, JP Morgan, etc), to quickly generate liquid and pay off the loan more slowly, with the assets at a higher value. The problem with this is that the SPX at which the loan was taken out was trading much higher than it is now, meaning the dollar loan amount is now worth more, increasing the interest against inflation. Put short, they lost a lot of money.

It’s currently high, but it appears to be riding the SPX/SPY upwards. This momentum will most definitely reside, either naturally or via an economic crash (which is pretty much agreed will occur at this point).

I think the other thing driving the current price rise at the minute is FOMO (fear of missing out). People unfortunately are believing they are “buying the dip”, which it doesn’t yet appear to be.

In the next few weeks, there is likely to be a crash down to approximately 14k. The cause could be a recession, Chinese property market crash, other liquid assets being unable to be accessed for any reason, Voyager or Celsius going fully bankrupt, more large dumps or easing of FOMO buy-up. Any one of these reasons could start it off.

Let’s see how it goes.

If you are currently holding, I suggest to try and mitigate your risk against another crash. 50% of something is better than 100% of nothing, especially if you are really dependant on that money. Good luck.