Coffee Space

Coffee Space

Last Christmas, I made the following prediction:

- Global Economy - It’s still unclear to me whether a global collapse will happen, but I highly suspect it will all depend on China at this point. It’s well known they fudge their numbers, but the problem is they also bailed out much of the debt back in 2008. If market confidence in China collapses, it could cause a global recession.

I really didn’t expect it to come true so fast - sometimes I scare even myself.

I was sitting on an article for later reading that was published on the 4th September. Had I taken the time to read it, I would have realised much earlier that a major prediction I had made earlier may be about to come true.

Here’s something you can quote me on:

Chinese money is worth so much less than the paper it is printed on, that they switched to digital payments.

I wish I was kidding. As we’ll discuss, this flimsy house of cards might just about be prepared to fall.

The article by the Economist named ‘China’s dodgy-debt double act’ is a very interesting read (or listen). This article has some very interesting points:

Now these claims are being tested by crises at Huarong, a state-run financial conglomerate, and Evergrande, the country’s largest property firm. Together they have some $540bn of liabilities, which they will struggle to repay.

At the time of writing, Wikipedia reports the nominal GDP at $16.64 trillion, we are talking about 3.25% of their economy potentially being wiped out over night.

You may say “it’s not that bad, they have assets!”. Do they? Huarong are desperately handing off property assets to keep their largest investors happy - and they are still massively in debt. They literally do not have enough assets or even promised future assets to make up the shortcomings.

The default rate on bonds is artificially low and expected to be no more than 1% this year, far below the global corporate-default rate of around 2.7% last year. China’s state-owned banks may be willing to express their admiration for Xi Jinping Thought, but they hesitate to confess to their dud loans.

And here you have the fundamental problem, Communists do not want to hear that their ideology is not working. They literally could not report on this situation even if they wanted to. As a result, they keep lying to keep the politicians happy, until one day they can’t, and then it’ll be their heads that roll.

What can we assume from this? These two debt giants that are about to collapse are not the only ones! It’s quite likely that there are other large companies also on the brink of collapse.

Huarong was set up in 1999 as a bad bank for soured loans, but became a conglomerate. On August 29th it reported delayed results indicating liabilities of $238bn in June, a $16bn loss last year, and a leverage ratio of 1,333 times. Two days later Evergrande, with property projects in over 280 cities, reported liabilities of $304bn and sustained a profit by selling subsidiaries.

It’s impressive that such a large bank can actually post such large losses year on year. These are enormous numbers involved.

What about Evergrande? The government may let the mainly foreign owners of its $21bn in foreign-currency debts go to the wall.

The thing is though, by failing to repay foreign investors, it’s quite likely that market confidence will fall even further. External investment is what gives internal investors confidence! One can only hope that this is a very expensive lesson for foreign investors.

This sort of thing keeps me awake at night. I hope to high hell foreign investors, i.e. the West, have not invested so heavily into the Chinese market. $21 billion USD is low-exposure, but I really suspect this number is a lot higher and investors are trying to not reveal exactly how bad their portfolio currently is:

In a note to clients last week, UBS said: “We continue to hold Evergrande in fixed maturity funds because exiting the position at this point removes any optionality around a successful resumption in construction activity, external financial assistance, or policy adjustment in the coming months, and Evergrande bonds are now trading at or below typical historical recovery values”.

This is what they are missing: It’s well known that the Chinese property market is a massive bubble - beyond any imagination. Houses are built simply for the purpose of investment opportunities, not due to demand. These houses are often sold before the first brick is even laid, or before the land is even acquired for the build itself, with the promise something will be built in coming years.

The reason for this massive push towards investment into the property market in China is an artificially created environment by the CCP to only invest locally. Getting money out of China is notoriously difficult, to the point they have entirely banned crypto trading to stem a cash bleed. Other than infrastructure on quick-lived companies (that have a habit of renaming or evaporating), there really is not much to invest in at all.

As I said before, if two of you largest companies in the Country are about to collapse, people start asking questions about the others. Speculation in the markets causes panic, panic can artificially crash even the healthiest of stocks.

In an article by Reuters, it appears this idea of a stock crash contagion is growing:

Evergrande’s troubles also pressured the broader property sector, with Hong Kong-listed shares of small-sized Chinese developer Sinic Holdings (2103.HK) down 87%, wiping $1.5 billion off its market value before trading was suspended.

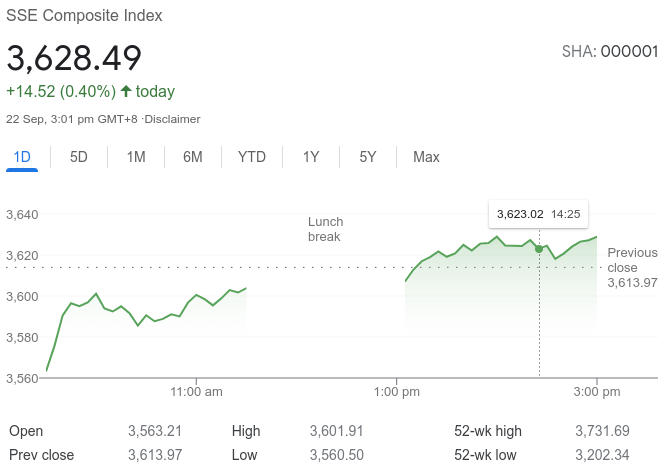

There is so far no sign of this slowing down yet either. Looking at the Shanghai Stock Exchange, since the 10th of September, stock has dropped from some 3703.11 down to 3614.03 on the 17th of September. This represents a 2.5% drop in just 7 days… Bare in mind, Evergrande and Huarong haven’t actually defaulted yet.

“(Evergrande’s) stock will continue to fall, because there’s not yet a solution that appears to be helping the company to ease its liquidity stress, and there are still so many uncertainties about what the company will do in case of a restructuring,” Kington Lin, managing director of Asset Management Department at Canfield Securities Limited, said.

“Beijing has demonstrated in recent years that it is fully able and willing to step in to stem widespread contagion when major financial/corporate institutions fail,” Alvin Tan, FX Strategist at RBC Capital Markets, said in a research note.

I hear that it’s highly unlikely that the government will actually bailout these companies either. They are leaving it highly late in the game if this is their plan…

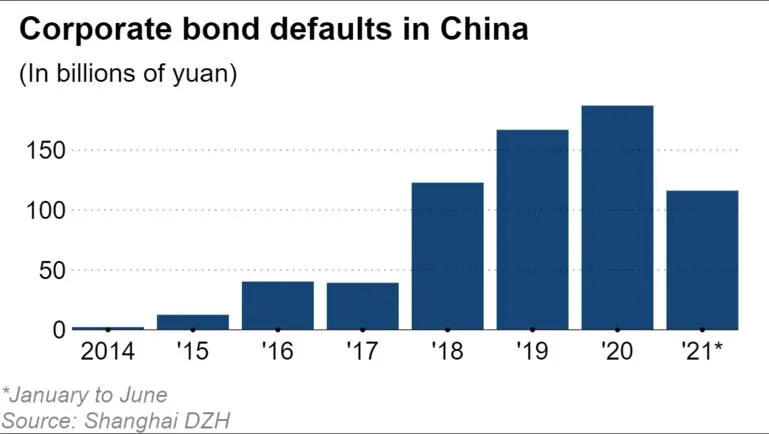

According to Nikkei Asia, China is posting record corporate debt defaults:

Chinese corporate bond issuers defaulted on about 116 billion yuan ($18 billion) in the first six months of 2021, the highest figure for any January-June period.

This problem is only increasing, despite pressure the CCP to halt or even reverse it. They will likely be having some affect, but the CCP has an uphill battle against the global pandemic and all the related fallout.

It’s as if the CCP have been asleep at the wheel - how did they not see this as a problem? I suspect they did, and have already been planning for this scenario. China have been trading their bad money for precious metals and US dollars. They have been working on their belt and road initiative, increasing foreign investment under careful management by the CCP. The result? If China crashes, the entire global economy will crash - everybody is exposed.

The missed payments are alarming foreign investors and driving up the average yield on foreign currency-denominated Chinese corporate bonds with low credit ratings to above 10%.

The writing is on the wall. This will only get worse.

The government of President Xi Jinping is placing a priority on reducing excessive debt in the corporate sector. By doing so, however, it risks pushing a legion of companies into difficulty with financing their businesses. That could then choke the nation’s economic growth in the coming years.

Right, in theory some of these companies might need to finance even more to get out of the lurch, not less. But of course the exposure climbs even higher. Bejing would probably rather see these companies crash entirely and cut their losses - but we’ll see.

In particular, a growing number of state-owned enterprises (SOEs) are missing debt payments, a sign of Beijing’s willingness to run counter to the long-held assumption among state-linked borrowers and their investors that the government will bail them out when they tumble into financial trouble. For decades, SOEs have enjoyed “implicit debt guarantees” by the central and local governments, but they can no longer take government support for granted, according to Shinichi Seki, an economist at the Japan Research Institute.

It’s not just willingness to let these companies fail, they literally can’t stop them - the exposure in now way too high. Let that be a warning to foreign investors though - the CCP will not be your insurance policy. In fact, they would happily see you lose your money.

Chinese companies will face major tests of their financial health in the next couple of years, with $2.14 trillion of bonds maturing by 2023, 60% more than the value of bonds that came due from 2018 to 2020.

It’s really not clear how they get out of this. If they don’t fail now, it looks like we have a date to keep an eye on - 2023.

But investors have responded to the campaign by rushing out of junk bonds. If this causes a credit squeeze for a large number of Chinese companies, the nation’s economy could take a massive hit, derailing Beijing’s strategy for a soft landing.

Well duh, they never should have invested into junk bonds anyway. They just thought they could dip their toes and make a quick buck - but of course it’s gambling and somebody will be left holding the bag of shit.

So there appears to be a problem. What can China do to buy time?

Seize the private property comrades. CCP’s Xi has called for “redistribution” for “common prosperity”. In the context of the ongoing economic crisis, we can translate this to “we need the prospering businesses to use their wealth to buy us more time”.

Recently we have seen ARM China undergo a hostile takeover which is seemingly supported by the CCP. Actions like this make China an increasingly hostile place for foreign investment.

I suspect in coming months we will see the big businesses like Alibaba (which was forcibly taken away from Jack Ma 1) bail out these other companies, exposing them to these awful investments. They will make huge losses on these companies to buy China more time, and will ultimately cause their investors to pull out. The irony here is that they will take profitable investments and make them very unattractive - potentially increasing their exposure causes by these bad companies.

To answer the real question here: Is the Chinese economy about to collapse? Possibly, but they can at least buy some time. As I said previously, if it doesn’t fail now, 2023 is the date to look for. If it does fail now, 2023 is still a date to look for.

With regards to Evergrande, there are going to be a lot of pissed off locals. These are not just rich people who were tricked into investing, it was middle-class people who were guaranteed a return on investment. Now, it’s looking more and more likely that the money has evaporated into thin air. They will turn their anger towards the CCP.

The CCP is completely unable to accept responsibility - their Communist entire mandate is based on the idea of ‘prosperity for all’. If they fail to provide this and their reputation flails, the people will want their removal. Their government will completely fail unless they are able to shift the blame, but this will require a narrative control on epic proportions…

If the CCP were planning something big and hostile, one might expect they would kick out free journalists from the China. You might expect that they would want to start controlling influential voices and removing those who do not conform. You may even expect a continued push towards complete and utter internet censorship. How about a massive expansion of their nuclear arsenal? Whether or not these things translate to hostility is yet to be seen, but the pieces are there. This does appear to be the smoke before the fire.

Of course, after the recent US cock-up in Afghanistan indicates that the US may not be willing to protect its allies as it has historically promised, which includes Taiwan. There has therefore been a lot of speculation regarding a move by China on Taiwan. Why? National pride, natural resources and a welcomed distraction from economic disaster. The absorption of a massive economic powerhouse could even help curve the debt for many years to come.

It’s not yet clear, but China’s CCP may have just about clawed it back around:

This of course could just be a false rebound and it’s worth keeping an eye on the markets, but it appears that 2023 will be the next moment to look out for.

As a Zero Hedge article outlines:

I think the Evergrande will accelerate the Recentralization and Delinking that has already started in China. The Communist Party is reasserting to anyone and everyone, their control over China. With their treatment of Jack Ma and others, they seem to be taking the Russian proverb “The tallest blade of grass is the first to be cut by the scythe” to heart. China, with a billion people to feed and keep mollified (if not happy) will have its hands full dealing with an economic slowdown and a middle class hurt by a property bust. China will likely take steps to “fix” that since it is necessary for the survival of the CCP. I highly suspect, their solutions will hasten them along the path of recentralizing control within the party and delinking from global influences detrimental to their goals.

Evergrande is not a moment, but, for me, is confirmation to expect China to impact the global economy and thus markets, negatively for the near term and medium term at least. Companies need to have an urgency in assessing and updating their China plans.

Nuff said.